In the second season of “Bad Banks”, a green start-up shakes up the financial industry. Is Tomorrow the “real” role model there? Well, we do see a few differences.

Tomorrow is just a year old - and it seems as if we’ve not only made reality a little better, but also inspired fiction. The second season of “Bad Banks” has been available since the weekend. The young investment banker Jana Liekam is once again at the center of the multi-award-winning series. But this time it’s not about manipulated balance sheets and the near outbreak of the next financial crisis, but about the decline of traditional banks - and how Jana’s employer, the major bank Global Invest, is trying to defend itself with its own incubator for fintechs.

Jana’s mission: she is to take over the sustainable start-up Green Wallet and lead it to success. However, the competition from Fin21, at least as far as the number of customers is concerned, is already much further ahead. But sustainability isn’t an issue there. Financial success is the important thing for Fin21.

So it’s about new forms of banking - and the big question is whether they should make the world just a little more comfortable and hip, or better and more sustainable. We think it’s great that this question is now being tackled in front of an audience of millions. The more people think about what their money can do, the better! To that extent, the second season of “Bad Banks” is not just a fast-paced and brilliantly executed show. It also draws attention to an important current topic.

But now for the reality check. “The dispute between Green Wallet and Fin21 clearly reminds us of the competition between Tomorrow (nickname:”N26 for eco warriors”) and the important banking startup N26 itself,” writes Finance Forward, an offshoot of the business magazine Capital. Well, on the one hand it is of course nice to be seen as an equal competitor for N26 (N26 has more than 5 million customers, Tomorrow just under 22,500). However, there can be no question of a “confrontation” as in the series, where Jana calls right from the start to “aggressively exhibit against Fin21” with Green Wallet. We’ve just invited the colleagues from N26 via Twitter to binge watch “Bad Banks” together - the pizza and beer were on us, of course. We don’t want to attack anyone, but rather to start a conversation.

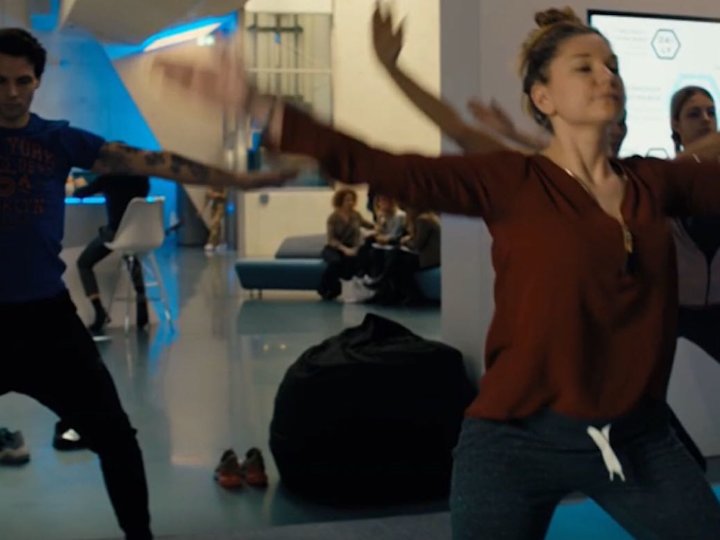

Otherwise there are a few differences between us and Green Wallet. Their series start-up is a robo-adviser, and we are above all the provider of a sustainable current account? Well, there’s that. All the sustainability hipster clichés that Green Wallet uses in the series made us roll our eyes a bit. There is the tattooed guy,the eco warrior woman and the sensitive founder with occasional flares of psychosis. “The Green Wallet employees seem to have jumped straight out of a hipster catalogue,” the Tagesspiegel writes quite aptly. It’s a shame that screenwriter Oliver Kienle only recently became aware of Tomorrow, as he admitted to Finance Forward. Otherwise he might have got a bit more of a realistic picture.

Another difference is even more important to us. In the series, Green Wallet sells up to Jana’s major bank Global Invest because an opportunistic (and rather sleazy) investor suddenly turns off the tap. Later Global Invest also buys the competitor Fin21 - and then simply winds up Green Wallet. Sustainability, it becomes clear at the end of the series, was always just a fig leaf for the powerful bankers. In the end, they crush the idealists without hesitation.

That, we are convinced, will not happen to Tomorrow. This is because we deliberately looked for investors from the sustainability sector who believe in our mission and won’t let us down. Because our ideals are not for sale. And because more and more people understand that sustainability is not a fig leaf, but the future.

Even if the series doesn’t have a happy ending, then at least the reality does.