Find out how you are protecting the rainforest with our card, how we offset CO₂, how the projects are certified, who our partners are and everything about our selection process and investment criteria for companies and projects.

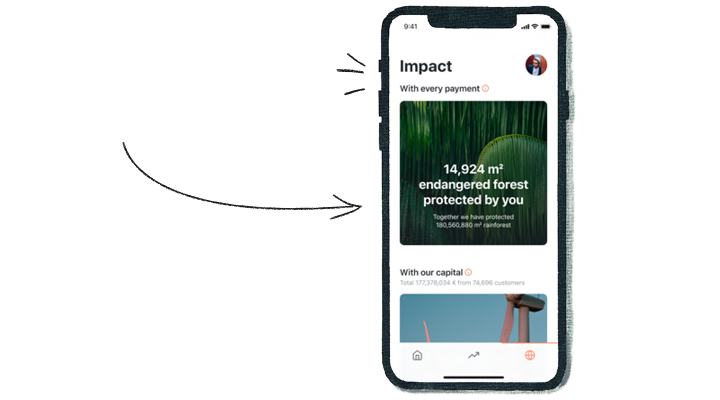

How you are protecting the rainforest with the Tomorrow card:

Every time you use your Tomorrow card to make a payment, you are making a valuable contribution to protecting the climate. This is all thanks to the “interchange fee”: for transactions with Visa, retailers (such as supermarkets or restaurants) pay a fee to the cardholder’s bank. That is a globally established system – and a source of income for many banks.

But instead of pocketing the money for ourselves, we donate it to a rainforest protection project in Portel, Brazil. And the more often the card is used, the more square metres of rainforest will be protected. See how much we have already achieved together on our Impact Board – and you can check how much of a contribution you’ve made personally in the Tomorrow app.

With every card payment, not only is the rainforest being protected but the project we support is also working on officially securing land rights for the Ribeirinhos, the inhabitants of the Amazon. This means that the area is no longer left unutilised and agricultural businesses cannot legally occupy it. For this project we are working with ClimatePartner, who coordinates everything in Brazil for us and makes it possible for us to help protect these areas. Find out more about the project here.

Offsetting CO₂ with Zero:

With Zero, our premium account, you can offset the average carbon footprint of a person in Germany – around 11 tonnes per year. Here we use the annual per capita CO₂ emissions, which are based on a calculation by Germany’s Federal Environment Agency. The annual CO₂ footprint is made up of the following: housing and electricity (2.74 tonnes), mobility (2.09 tonnes), food (1.69 tonnes), other forms of consumption (3.79 tonnes) and public emissions (0.86 tonnes).

Around 0.95 tonnes of CO₂ are offset by Zero every month. We do this with the monthly usage fee for our accounts, which we use to finance CO₂ certificates (more about that later on). Here too we are working with ClimatePartner, which monitors the projects and coordinates everything on site.

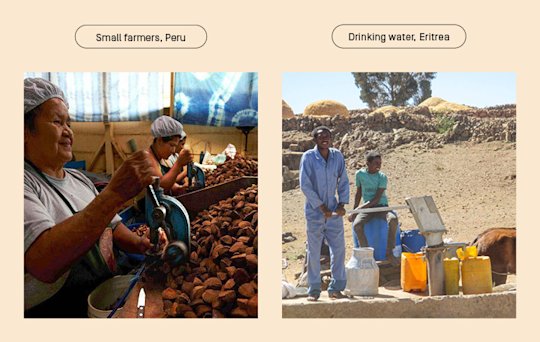

We are currently supporting two projects with Zero:

The first one supports smallholder farmers in Peru, which around 400 local families in the region have profited from so far. These farmers are given the rights to land, which they can use to harvest Brazil nuts on, for example. The trees, which are up to 60 metres tall, have always been a natural part of the rainforest. In addition, the farmers receive micro-loans and support with marketing and processing the nuts. This enables them to earn a living that doesn’t result in the deforestation of the rainforest.

And we are also supporting a drinking water project in the Zoba Maekel district of Eritrea, in north-east Africa. The scheme is geared towards repairing broken wells with a view to securing a supply of clean drinking water for as many people as possible in the long term, as well as minimising carbon emissions and introducing more resource-friendly practices. Many families have no other choice than to boil water on an open fire using the simplest means. This causes CO₂ emissions and, in some regions, leads to greater and greater areas being deforested. These CO₂ emissions can be avoided by treating the water chemically (for example with chlorine), mechanically (with water filters) or by making groundwater from wells accessible.

We have chosen projects in the Global South that are aligned with the sustainable development goals of the United Nations (SDGs) because climate change is taking a greater toll on the people there, even though they have contributed least to the problem. Climate justice is an important topic that we also want to work on with you.

Discover more about the projects and Zero either here or in your Tomorrow app. You will also find details about projects that are now fully financed or completed.

How the projects are certified:

Projects are selected based on the certifications and seals established by the United Nations and recommended by the German Ministry for the Environment, such as the Gold Standard or the Verified Carbon Standard. Supporting verified climate protection projects and certifications with international standards ensure not only that CO₂ is reduced but that the 17 United Nations Sustainable Development Goals (SDGs) are promoted at the same time. We work together with ClimatePartner to select and monitor the projects. The approach taken by ClimatePartner and the seals it issues have been verified and approved by a German government initiative (Siegelklarheit.de).

How certificates are used to offset CO₂:

Each certificate corresponds to a tonne of CO₂ saved by a climate protection project. The certificates can be acquired by climate protection projects that reduce or bind greenhouse gases – for example through forest conservation. This allows CO₂ emissions emitted elsewhere to be offset, while the money is channelled into sustainable projects and technologies, thus ensuring an environmentally friendly use of the world’s resources in the long term.

You can see here on our website or in the Tomorrow app which certificates the individual projects have. For Zero, we group together the offsetting amounts of all Zero users for the month and retire the corresponding credits.

Basic rule for CO₂ projects: We need to approach CO₂ projects on three fronts – avoidance, reduction and offsetting. Offsetting comes into play in cases where it is not possible to avoid or reduce CO₂.

To give our customers a better understanding of their individual carbon footprint, we have developed a Footprinting feature that can be used in the app. This allows you to pinpoint which of your daily activities cause the most CO₂ emissions – in other words, where the greatest potential for reducing CO₂ exists. You can read here how exactly this works and how it is calculated.

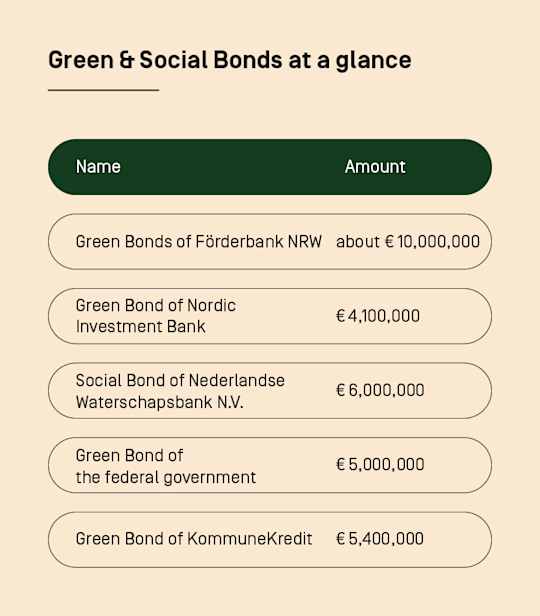

How our customer deposits are put to use

Part of our positive impact comes from investing in green and social bonds that are financed by the deposits that our customers have in their accounts. Green bonds or environmental bonds are fixed income securities with a clear commitment to social and environmental goals – and therefore an important lever when it comes to changing our economic system. Here are our current green and social bonds at a glance:

This means that our total impact investments now amount to over €31,500,000, which can be used to finance renewable energies, climate-friendly transport, affordable housing and sustainable communities. And if you’d like to get into even more detail, you will find the corresponding ISIN numbers of the bonds in our Sustainability Report.

Our selection processes and investment criteria

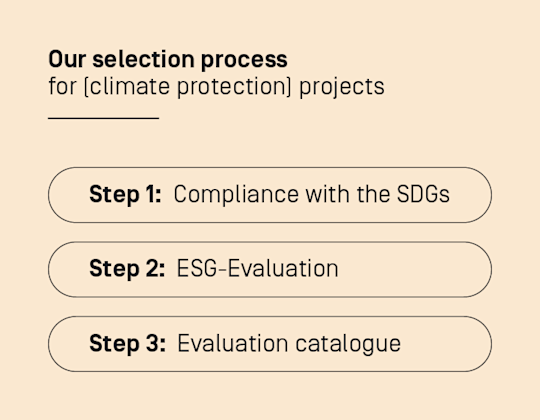

The selection process for our (climate protection) projects

We have a clear selection process when choosing the projects we want to finance:

Step 1: We have summarised the “Sustainable Development Goals” set out by the United Nations into categories: guaranteeing basic needs, empowering disadvantaged groups, protecting the climate, preserving natural resources and promoting fairness. Only projects that make a significant contribution to these five challenges can potentially receive support

Step 2: This is followed by the “ESG (Environmental Social Governance) evaluation”, which evaluates not only the ecological, but also the social and ethical footprint of the project. Does it pay fair wages? Does it have a low carbon footprint and a diverse workforce? Only if a project can guarantee a positive impact will it be eligible for financing.

Step 3: If the project can guarantee a positive impact, we take a closer look at the organisation responsible for it: How much money will actually be invested in the project? How much will be used for administrative costs? How much impact does one euro have on this project? For this purpose, we have developed an extensive concept. An organisation has to score at least 6 out of the 10 points in our assessment checklist to be eligible for financing.

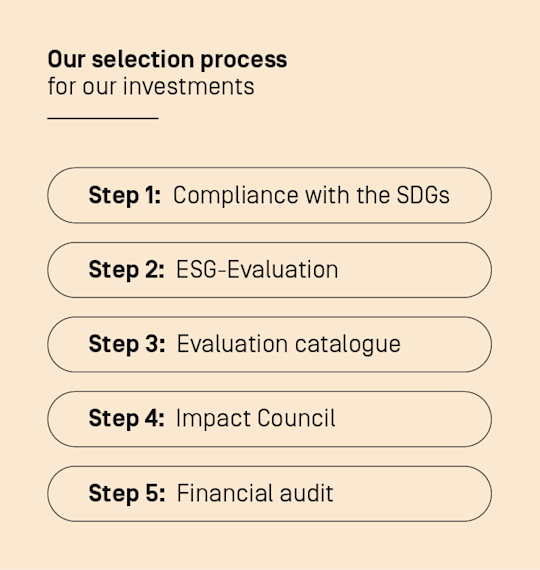

The selection process for our investments

Step 1: We have summarised the Sustainable Development Goals set out by the United Nations into five categories and begin by checking projects based on these: protecting natural resources, guaranteeing basic needs, protecting the climate, promoting fairness and empowering disadvantaged groups. Only projects that make a significant contribution to these five challenges will be considered for financing.

Step 2: This is followed by the “ESG (Environmental Social Governance) evaluation”, which evaluates the ecological, social and ethical footprint of the project: Does it pay fair wages? Does it have a low carbon footprint and a diverse workforce? Only if a project can guarantee a positive impact (and isn’t blacklisted by us through its ties with the arms industry, factory farming, coal, etc.) will it be eligible for financing. A more detailed definition of what we assess can be found in our Investment Criteria.

Step 3: Companies that meet our positive criteria and work to promote issues such as the circular economy or universal access to clean drinking water and sanitary facilities are then taken into further consideration.

Step 4: To do justice to the complexity of current social and ecological challenges, our interdisciplinary and independent Impact Council is responsible for the final evaluation and, based on this, for deciding whether to potentially invest in the companies and projects in question.

Step 5: It is only at this stage that our partners review the financial viability of the projects and put together the portfolio.

Our criteria for investments

The term “sustainability” is not protected and greenwashing is still a common practice, particularly with financial products. Because of this, transparency is extremely important. We ensure that you can inspect our investment criteria at any time – i.e. the criteria based on which we examine each potential investment for you. This is done through our customer deposits and also through the companies and projects included in the portfolios of our future investment products. The investment criteria include a total of 100 positive and negative criteria based on which all investments, companies and projects are examined before any money changes hands. We have listed them all in detail here.

Our partners

Solaris SE – Partner bank

We are a banking provider, not a bank. We work with Solaris SE from Berlin, which makes its banking licence and core banking systems available to us. This partnership with Solaris SE enables us to focus on our core business and putting our customer deposits to good use. We decide what we do with our customer deposits and how we invest them ourselves and the CO₂ offsetting as part of Zero is also irrespective of Solaris SE. This is how we guarantee that our customers’ money is only ever invested in companies and projects that we have carefully selected ourselves.

Evergreen – Investment advice for investment products

For the consistently sustainable investment products we currently have in the pipeline, we are working with Evergreen. Evergreen GmbH advises the capital management company that manages our investment products. As a member of the United Nations Global Compact, Evergreen is obligated to abide by sustainability principles and actively supports the 17 Sustainable Development Goals.

Climate Partner – Climate protection projects

We work with ClimatePartner for our Zero climate protection projects and our interchange fee (that protects the rainforest with every card payment). They take care of the coordination, checks and certification of the projects.

As soon as new partners join us, we will inform you here.

Our Impact Council

In autumn 2020, we also set up an Impact Council that is fully focused on sustainability at Tomorrow. This committee is made up of five experts from the realms of civil society and science, whose perspectives and expertise cover the many dimensions of sustainability. They meet up four times a year and, as our independent regulatory body, check the sustainability performance of Tomorrow at regular intervals. To find out who is in our Impact Council and which other authority we are evaluated by, read more here.

How we are offsetting CO₂ as a company

As a business, of course we also emit CO₂. But we are a certified climate-neutral company. Our focus is on avoiding, reducing and offsetting CO₂. We avoid CO₂ by not having any bank branches, by opting for green electricity, by using recycled paper (and as little of it as possible, preferring instead to concentrate on digital communication) and by using climate-neutral shipping. If any of our employees don’t own their own bike, they are provided with one from Swapfiets, the bicycle rental service. And, wherever possible, we travel by train rather than plane for our business trips. We reduce our CO₂ emissions with an efficient IT infrastructure and packaging-free and sustainable procurement guidelines. And we offset CO₂. You can read how and with which project we did that with in 2020 in our Sustainability Report.

Tomorrow is a B Corp

B Corp stands for “Certified Benefit Corporations”. In other words: for profit-oriented companies that don’t use their business solely for the purpose of maximising profits but rather for creating added value for society and putting ecological sustainability into practice. To qualify as a B Corp, a company must meet rigorous standards with regard to social and environmental responsibility, performance, transparency and company structures.

They also have to demonstrate how they are making a specific contribution to resolving societal problems and protecting the environment and also undergo an assessment. Read everything you need to know about this process and our score from B Lab here.

And in 2021 we were also named one of the best B Corps worldwide. Discover more about that here.

Interested in even more facts and figures? Read our Sustainability Report for 2020 here.