There are many ways to organise your finances in a relationship. For our new Money Matters format “Finance Check”, we asked Eike and Jonas how they tackle the issue and what their priorities are.

How much money do you have at your disposal each month? Do you have a joint current account or not – and how are you planning for your retirement? Yes, that’s right, it’s time for our Finance Check again! This time, Eike and Jonas couples are spilling the beans on how they organise their everyday finances. Let’s get started:

What is your net disposable income each month?

Together we have around 4,400 euros a month.

Who earns the most?

We both earn around the same amount.

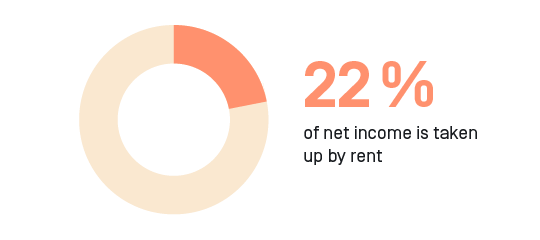

Are you renting or buying – and what percentage of your wages goes towards your living costs?

We rent a spacious three-room flat, which costs us around 22% of our monthly income. Fortunately, the rents aren’t that high where we live, but the main reason we live here is because we’re not really city people. And as far as work is concerned, it’s not a problem: Jonas works nearby, and I work from home.

Where do you live?

We live in a mid-sized town within commuting distance of Hamburg.

What kind of an account model do you have and why?

We both have our own accounts plus a third, joint account, which we each pay the same amount into every month. Our rent, utilities, groceries and smaller purchases for the flat come out of that account. We always split the costs of bigger purchases 50/50. As we both earn the same, that makes the most sense for us. For individual expenses, we each still have our own accounts as we spend different amounts of money on our hobbies, which we finance ourselves.

We don’t hold out much hope for the state pension that awaits us

How are you planning for your old age?

We don’t hold out much hope for the state pension that awaits us, which is why we’re each making individual provisions now. I (Eike) have a company and a private pension and Jonas has a private pension and investment funds.

Would you both have financial security if you were to split up?

Definitely. We both have a salary that we could live off if we were to split up and we’re not planning on having children, so we’re quite financially independent from one another in that respect.

What is particularly important to you in your relationship when it comes to money?

We’re both quite frugal people, which is why it’s important to us to discuss bigger purchases together before making them. And we split the costs very carefully here too. But at the same time, we’re not petty about the small things: we don’t make a big deal about who paid for the ice creams last time, for example. That’s not something we really pay attention to. We just want things to be as uncomplicated as possible.

Find out more

Read Katharina and Leon’s Finance Check here. Together they have a joint budget of 5,900 euros a month. They told us how they are managing their money, now and for the future.

And here you can find the first edition of our Finance Check with another four couples who told us how much they earn, how they organise their finances and how they are making future provisions.

Do you want to use a joint account but aren’t quite sure how to merge your finances yet? Here are two specific examples to help you.

Du willst mobiles, nachhaltiges Banking? Dann eröffne jetzt dein Tomorrow Konto.