How much money do you have at your disposal each month? How do you organize your finances as a couple and what provisions did you make for old age? These are the questions we asked Monika and Bernd, who are both retired.

It’s time for another Finance Check! In this latest instalment, Monika tells us how she and her husband Bernd tackle the topic of money in their relationship, how much money they have each month and what provisions they made for their retirement. Because unlike the couples we have featured before them, they are already retired.

In the interview, you will find out what role inheritance plays in safeguarding their future, how they would each manage financially if they were to split up and where their opinions on money differ completely – not to mention how they solve their financial-related differences in a very pragmatic way.

How much of a net disposable income do you have each month?

Together we have €4,100 a month.

Do you both contribute the same amount financially?

We used to earn around the same, but I (Monika) receive a slightly higher pension. However, Bernd also has a so-called ‘mini-job’ that brings in €450 a month, which more or less balances it out.

Are you renting or buying?

We live in our own home on the outskirts of Saarbrücken, half of which we inherited. That means we have a monthly mortgage to pay off the second beneficiary.

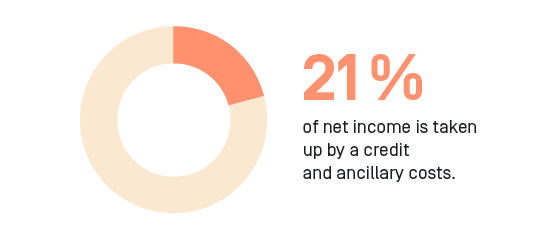

What percentage of your joint net income goes towards the mortgage and utilities?

It works out at 21% a month.

How do you organize your joint finances on a daily basis?

Each of us pay certain fixed costs, but it’s not based on our earnings or any specific rules. We each have our own accounts. Doing things that way gives us both a feeling of freedom and independence, which is important to us.

We’ve always meant to sit down and do a finance check together and work out exactly who pays what to make sure that it’s fair. But it’s something we never seem to get around to. The way things are at the moment just works best for us. We’ve also been planning to open a joint account for a while now, to help us split our costs better. We still haven’t done that yet, though.

What pension provisions did you make?

In addition to my state pension, I also have a company pension, which I automatically paid into from when I started working. After 42 years of working with the same employer, that comes to an additional €400 each month.

After separating from my first husband, I also started putting money in a fund. To begin with, I used the money from a building loan contract that I cashed in. And a few years ago, when I realized that I had a little money left over each month that I could use, I started regularly paying that in too.

Bernd also has his ‘mini-job’ in addition to his state pension. As well as that, we have a rental income of €200 a month, which also makes up a small slice of our pension provision. Our children are also financially independent and, as I mentioned, we inherited half of our detached house.

I like to have structure and a clear budget for anything life might throw at us.

Would you both have financial security if you were to split up?

Yes, each of us could live off our own income, which means we would both have financial security.

What is particularly important to you in your relationship when it comes to money?

That’s something we need to try to be objective about because we have such different priorities in life. Bernd isn’t keen on making plans and prefers to decide things spontaneously. I like to have structure and a clear budget for anything life might throw at us. My solution for that is the Pocket sub-accounts where I can put money aside for different reasons. In our everyday life together, we just take it in turns to pay for the shopping and aren’t very strict about working out exactly who spent what each time.

More about money:

Lynn and Christian have €3,700 a month at their disposal. How do two tax advisors manage their joint finances? Find out in this instalment of our Finance Check.

Read here to discover how four couples with very different budgets tackle the topic of finances in their relationships.

And click here to read the 38 most important questions on the topic of money and relationships that you and your other half should be asking each other.

Money alone doesn't make you happy: open your sustainable account with a dedicated section for shared finances.