There are many ways to organise your finances in a relationship. For the new edition of our Money Matters “Finance Check”, we asked how Katharina and Leon tackle the issue and what their priorities are. Let’s get started:

How much money do you have at your disposal each month? Do you have a joint current account or not – and how are you planning for your retirement? Yes, that’s right, it’s time for our Finance Check again! This time, Katharina and Leon are spilling the beans on how they organise their everyday finances.

What is your net disposable income each month?

Our joint net salary is currently 5,900 euros. That can change though, because the number of hours we work each week is adjusted once or twice a year – depending on family obligations and work opportunities.

Who earns the most?

Leon’s salary has a variable component, which changes somewhat. Most months we earn the same, but other months one of us might bring in 100 to 200 euros more.

Are you renting or buying?

We rent a four-room flat and in terms of its value for money, we were really lucky. Buying our own place is out of the question for us at the moment because it would be really expensive in the area we live in now and we don’t have sufficient capital for a down payment. The few options that are available are so overpriced and we’re not prepared to get into so much debt just so we can own our own home.

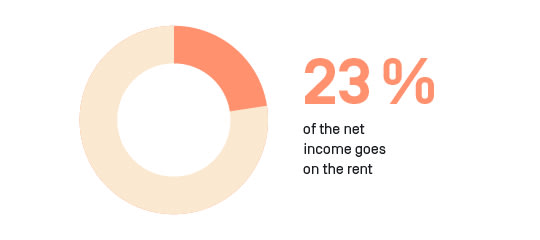

What percentage of your wages goes towards your rent?

23 percent of our net income goes on our rent. We’re relieved that it’s not more. But not everyone who lives in this area can say the same.

Do you live in the city or the country?

We live in the countryside, but close to a largish city in Baden-Württemberg. We have relatively good public transport options to get into the city, but it’s not the same as living in the city itself. So for our two cars, including taxes, insurance, repairs and petrol we spend around 350 euros a month. If we were to move into a more expensive apartment in the city, we would try to do without cars all together.

What kind of an account model do you have and why?

Each of us has our own account that our wages are paid into and our own outgoings are deducted from, such as insurances, subscriptions, clothes or books. And then we also have a joint current account and a joint savings account. Currently each of us transfers a similarly high amount to our joint current and savings accounts. When she was on maternity leave, Katharina paid in less. We cover the costs together but how much we each contribute is proportional to our incomes. Once a year we sit down and check our outgoings, i.e. how high our fixed costs are, what has changed and what we are spending on food, clothes, subscriptions, books or gifts. That gives us a good overview of everything.

How are you planning for your old age?

We aren’t following a clear plan, but we do have a few different pension pots on the go. We have a classic Bausparvertrag (building society savings account) so perhaps we’ll be able to buy a place of our own in the near future. And we each have a company pension as well as a private one. We have both saved different amounts so far, but we want to balance them out. And we still need to set up a joint investment savings plan for ourselves as we already have one for our daughter. We haven’t taken any inheritance into account in our long-term plans. But we’ll definitely think about factoring in any financial support from our parents.

Would you both have financial security if you were to split up?

As it stands, we would both have a salary that we could live off. But then one of us might have to take on more of the childcare and forgo a salary, in which case we would have to compensate the other. But the question “Do we both have a pension that we could live off?” is very much on our minds at the moment and we’re pretty sure that we need to be making better provisions.

From the start, it has been important to us that we share the costs as fairly and equally as possible while still keeping our financial freedom.

What is particularly important to you in your relationship when it comes to money?

We have absolute transparency and can both look at each other’s accounts. From the start, it has been important to us that we share the costs as fairly and equally as possible while still keeping our financial freedom. But the chunk of our income that we don’t need for the joint outgoings (living costs and our joint savings fund) can be spent freely without discussing it with the other. We each like different things so it’s only fair that we can spend our own money on whatever we want.

Read on

You can find out here how four more couples organise their joint finances.

The three-account model: The simplest way for couples to organise their finances. This is how it works.

In search for a sustainable account which you can use together with your favorite person? Then you will find everything you need here.

Money alone doesn't make you happy: open your sustainable account with a dedicated section for shared finances.