Money in relationships: For the latest instalment of our “Finance Check” format, Marisa and Ludwig are revealing how they organise their joint finances. Let’s get started!

How much money do you both have at your disposal each month? How do you manage your money and why does that work so well for you – and how are you making provisions for your old age?

We have the answers to all of these questions and more, this time from Marisa and Ludwig, who told us how they organise their everyday finances in an interview.

What is your net disposable income each month?

It varies from month to month. I would say that we end up with 3,000 euros after tax each month.

Which one of you earns the most?

I (Marisa) am currently earning more, or rather I’m the sole earner right now, because Ludwig wants to start a new apprenticeship so he’s preparing for that at the moment.

Are you renting or buying?

We live with our daughter in a rented 70 m² apartment.

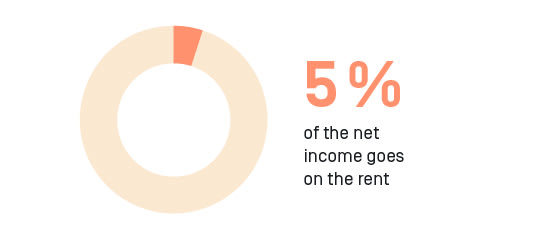

What percentage of your joint net income goes towards your living costs?

We are lucky because the apartment we live in belongs to Ludwig’s grandmother, so we only have to pay the running costs like utilities and bills. That amounts to around 160 euros a month, which isn’t very much at all. In our old apartment it was a lot more. But that was in the city centre of Leipzig.

Do you live in the city or the countryside?

We currently live in the country in a small town in Saxony. We moved here two years ago because it all got a bit too much in the city. However, I do have to say that we have really been missing the infrastructure of the city, especially during lockdown. We have felt quite lonely here – especially because it’s not that easy to get from A to B. But we can both work from home as there is enough space. When Ludwig starts his vocational training, we might end up moving back to the city. But the high rental costs in the city do put me off. At the same time though, it would be great to have everything close by.

How do you organise your finances?

We try to split the costs 50/50. But as Ludwig isn’t earning much at the moment, I am contributing more for the time being. We still have separate accounts, but that’s simply because we each kept the same accounts we had before getting married. Shortly afterwards, our daughter was born and then we had other things to think about. But I could imagine setting up a joint household account in the future, once Ludwig has a regular income again.

"Our daughter has a savings account, educational endowment insurance and an investment fund."

How are you planning for your old age?

We both pay into the state pension scheme. In addition to that, we also have a life insurance policy and an occupational disability insurance, that will be paid out when we retire. We also pay into an investment fund every month and put aside savings. Our daughter also has a savings account, educational endowment insurance and an investment fund. But it was her grandparents who set up the insurance and the fund for her.

Would you both have financial security if you were to split up?

We didn’t sign a prenup or anything like that before getting married because I was still studying at the time and Ludwig didn’t have a very high income. So in that sense we both went into the marriage empty-handed and didn’t think it was necessary to put anything in writing. As it stands at the moment, Ludwig probably wouldn’t have much financial security at all but once he starts his apprenticeship that will change. But, to answer your question, we’re not currently making any provisions in case we ever split up. That’s probably because we’ve only been married for one and a half year and separation is the last thing on our minds!

What is particularly important to you in your relationship when it comes to money?

Openness and clear communication. We believe that it’s important to communicate openly and clearly about money. And also be honest with each other about whether we can afford to splash out or not. Thankfully we usually agree!

Find out more

Read Katharina and Leon’s Finance Check here. Together they have a joint budget of 5,900 euros a month. They told us how they are managing their money, now and for the future.

And here you can find the first edition of our Finance Check with another four couples who told us how much they earn, how they organise their finances and how they are making future provisions.

Do you want to use a joint account but aren’t quite sure how to merge your finances yet? Here are two specific examples to help you.