Would you finally like to organize your finances and save money, but don’t want it to be complicated? No problem: just use the 50-30-20 rule! We show you how it’s done and how you can make it work for you.

Have you been finding it hard to organize your finances and regularly save money? Then why not make it easy for yourself? With the 50-30-20 rule – a really simple method that will help you finally get closer to fulfilling your dreams! This method is all about setting budgets and savings goals, which helps you to organize your finances in the long term and ensure that you are covering your fixed monthly costs, that you have enough money for dining out, going on trips etc. and also that you are building up enough savings. It’s really easy and works without you constantly having to calculate everything again each month.

Here’s how:

How does the 50-30-20 rule work?

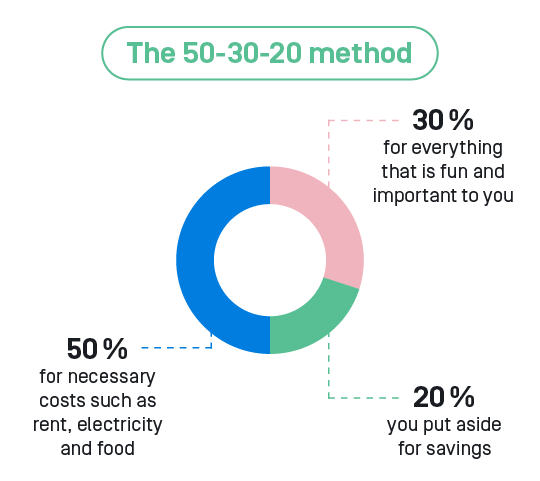

The 50-30-20 method is really simple: you spend 50% of your monthly budget on necessary costs such as your rent, utilities bills and groceries. 30% of your budget is spent on everything you enjoy doing and is important to you and the remaining 20% is put aside for savings.

If you still have debts, then start by using the 20% of your monthly budget until they have been paid off. Once you’ve done that, you can use the 20% to save up a rainy-day fund for emergencies. And after you’ve saved that, you can allocate the 20% to sustainable investments. This will help you build up financial security, step by step.

To make sure this breakdown works for you, it’s best to transfer the 30% for your leisure activities and the 20% for your savings into a different account at the beginning of the month so you’re not tempted to spend the money on other things. For those of you who have an account with us, you can use our Pockets (sub accounts) for that.

If you manage to stick to it, you won’t be living beyond your means and can build up a nice little nest egg. So, as you can see: it’s a really easy principle that helps you budget properly and can be used individually to suit you and your needs.

See the potential: How much percent of your income you can save

With the 50-30-20 rule, you save 20% of your net income every month. Not only does this give you a clear savings target, but also a solid amount that you can use to pay off your debts in the foreseeable future, to save up an emergency fund of at least three monthly salaries, or that you can invest. You shouldn’t have any more than your rainy-day fund sitting in your account anyway (learn more here); you’re better off making your money work for you by investing it in sustainable investment products.

If you think that allocating 20% of your wages to your savings is a bit too much or unrealistic for you, then why not see if you can make savings elsewhere? A finance check can help you with this: we explain how you do that here – and here you will find a whole host of saving tips that will really help you to reduce your basic costs on a daily basis. And after that, if you still aren’t able to save 20% of your income, then don’t get frustrated; just start as soon as you can. Maybe you can save 10% a month for the time being? That’s fine too, because your future self will thank you for every cent you manage to put aside! The main thing is that you have a rule you can stick to. Once you have that, you can go at your own pace.

Perhaps there’s a chance that you could increase your income soon: in case you’re planning on negotiating your salary this year, we have some really good tips for you here. After all, everything is a lot easier if you have more financial leeway. And everyone else should try to stick to the 20% rule.

How much can I save if I earn a net monthly salary of €3,000? An example

Let’s make it clear with an example: this is how much money you can save with the 50-30-20 rule and a monthly net income of €3,000:

€1,500 a month goes towards your fixed costs such as your rent/mortgage, electricity bill or mobile phone contract etc.

€900 goes towards your leisure activities such as dining out, trips or new clothes.

€600 goes into your savings pot, i.e. a Pocket sub account.

That means, in one year you could save a total of €7,200 – which is a helluva lot of money!

So when are you getting started?

More about money and savings: Here you can find more tips on how to organize your finances.

11 really good savings tips for everyday life. Read more.

You want to become financially independent? Then we have some ideas for you here.

Summarized for you:

Your most important financial To Do: Open an account with Tomorrow and protect the climate with every purchase. Download the Tomorrow app now and get started right away!