Do you want 2022 to be the year that you finally sort out your finances and make plans for the future? And having more money in your account would be nice too, right? Here are four useful tips on how to easily make that happen.

Was getting a handle on your finances one of your New Year’s resolutions this year? Good for you – because once you’ve done that, reduced some of your unnecessary monthly outgoings and followed a few tips that will help set you up for the future, you won’t only have fulfilled your resolution, but will also have even more money in your account. It’s not exactly rocket science – so what are you waiting for?

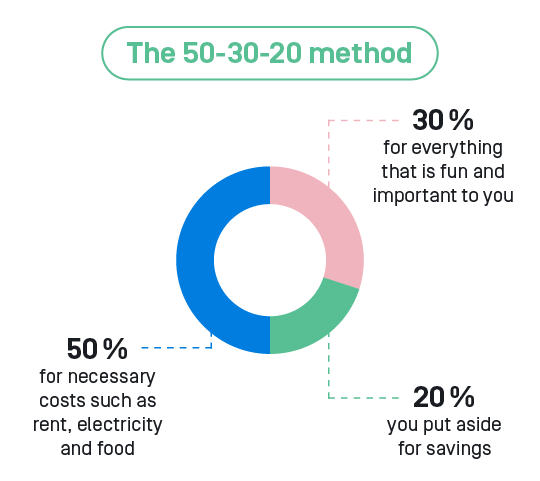

The 50-30-20 method: Budget properly and save

You need to start by gaining an overview of your finances. After all, if you don’t know exactly how much you are spending on what, you won’t be able to find out where there is saving potential. Sit down and work out how much money is coming into your account each month, your monthly fixed costs and your variable costs: make a note of how much money you receive (your monthly salary, and perhaps also any rental income you have) and your expenses. Your outgoings include your regular expenses such as rent, utilities bills or your mobile phone contract and your variable costs – for food, dining out or new clothes etc.

You can use the budget book in the Tomorrow app to do this. Take a long, hard look at the result: are these really the amounts of money you want to be spending and do you still have enough at the end of the month, or are you living beyond your means? If you’re not quite where you want to be, it would help to follow this next step:

This is where setting budgets and savings goals come into play. And you can do this, for example, using the 50-30-20 method. According to this useful budget rule, you should be spending 50% of your monthly budget on necessary costs such as your rent, utilities bills and groceries (needs), 30% on everything that you enjoy doing and is important to you (wants), and 20% on savings (financial goals).

To make sure this breakdown works for you, it’s best to transfer the 30% for your wants and the 20% for your financial goals into a different account at the beginning of the month so you don’t end up spending the money on other things. For those of you who have an account with us, you can easily use our Pockets (sub accounts) for that. If you manage to stick to it, you won’t be living beyond your means and can build up a nice little nest egg.

If you can’t quite manage to break down your money in this way because you have to make do with a very small budget, then divide it up the best way you can. Maybe you can only spare 5 to 10% for your savings – don’t worry about it, because even that will help you in the long term.

The important thing is that the total savings in your account are only the equivalent of around three monthly salaries. Anything over that amount should be put to work for your future self! See point 3. And in case you’re planning on negotiating your salary this year, then we have some really good tips for you here. After all, everything is a lot easier if you have more financial leeway.

Need more money? Then take a closer look at your contracts

Speaking of optimizing your budget, when you were going through your fixed costs you might have come across a few insurance policies and other contracts. From a financial point of view, it’s definitely worth regularly checking whether you’re still getting value for money from them. If you browse a few different companies to get a comparison, you’ll often find that there are cheaper options for all kind of contracts that offer the same cover. You should also ask yourself whether all your insurances are really necessary and still make sense for you personally.

If you’re worried that you won’t be able to get out of the contract quickly, we have good news for you: since December 2021, it is now possible to cancel your telecommunications contracts (for your smartphone or landline) after one month here in Germany, even if your contract says otherwise. So have a look to see whether you can find any potential for improvement that might save you a few pennies! And by the way, for all other contracts concluded from this March, the same applies. So the best thing to do is check your contracts with your electricity provider, gym etc. now to make sure you can cancel them at short notice. The effort it takes to switch providers is often rewarded with better rates. And, last but not least, now is also a good time to look into sustainable alternatives, in case you haven’t made the switch already.

Maybe you’re spending money every month on ongoing subscriptions. If you’ve said any of the following during your finance check: What on earth is that?!”, then don’t beat around the bush, just cancel them. Maybe you’re paying for subscriptions that your family and friends are using too. Then it’s worth taking stock here as well and seeing who can contribute how much to help split the costs.

All of that means more financial leeway for your budgets and saving goals. Or you can also use Plus and finally get started with sustainable investing.

Time is money: start saving for your future

As well as your monthly outgoings, budgets and short to mid-term savings goals, you should also set yourself some long-term goals.

Are you saving up for a major purchase? Or maybe you want to own your own home in the future or bump up your state pension? Or are all these things that you have never really thought about before? No problem at all, you can also decide later on.

Until then, you can use the time wisely and make your money work for you by investing it in a long-term and sustainable way. Sounds great, doesn’t it? Don’t worry though, contrary to popular belief you don’t have to be wealthy to do that! Because with a monthly savings plan you can also invest small amounts or you can start with a small one-off sum and find out how it feels for you, without taking too much of a risk. Anything is possible. The earlier you begin to invest, the smaller the amounts you start with can be – all thanks to the compound interest effect.

And soon we’ll be offering you a handpicked sustainable investment product too, which will enable you to invest in your future. Find more details and our waiting list here. Add your name to it and you’ll be among the first to find out our latest updates!

Your money mindset is more than just a buzzword!

If you’ve already started following a few of these tips, then you’ll already be on the right path towards a new financial start. But if the subject of money is one you prefer to avoid and you only stumbled across this article by accident, then it’s worth reshaping your money mindset, which – although it sounds complicated – is nothing other than your own relationship with money.

Finding out why you have a certain relationship with money, why it stresses you or why you avoid it like the plague, even if you don’t really have any financial worries, is not only fascinating, but will also help you make progress. Because although it won’t instantly change anything about your bank balance, it will help you look at things in a new way.

The best way to begin this process is by talking to other people about money, by telling them about your financial plans (“I want to start investing this year, is that something you do too?”), or about your reservations: (“The whole topic of money stresses me, but I don’t know why – how about you?”). Or you can share the tips you have learnt from this article.

Basically, you can’t go wrong by talking. Because communicating with others helps – whether about money or anything else that’s on your mind. For more conversation-starters about money, or if wish to learn more about your money mindset, click here.

More about money:

In our ‘Finance Check’ format, different couples tell us how they organize their joint finances. Click here to read our latest instalment featuring Eike and Jonas, who have a joint monthly budget of 4,400 euros.

Are you quite a thrifty person but dream of becoming wealthy one day? We explain why that won’t work here.

Looking for even more motivation to help you tackle the topic of finances? You’ll find everything you need in this guide. Click here.

Your most important financial To Do: Open an account with Tomorrow and protect the climate with every purchase. Download the Tomorrow app now and get started right away!