Good news! We have increased our impact investments once again in 2021. Read on to find out what this will be used to finance.

Together with you, we are directing money to places where it can help to make the world a better place: conserving forests, financing social projects in the Global South and offsetting massive amounts of CO₂.

As well as this, part of our customer deposits go into green and social bonds, which in turn are used to finance things like renewable energies, climate-friendly transport, affordable housing, better education and sustainable communities, making them an important lever for change.

And this is why we have now gone one step further and increased our impact investments to around €42 million in total.

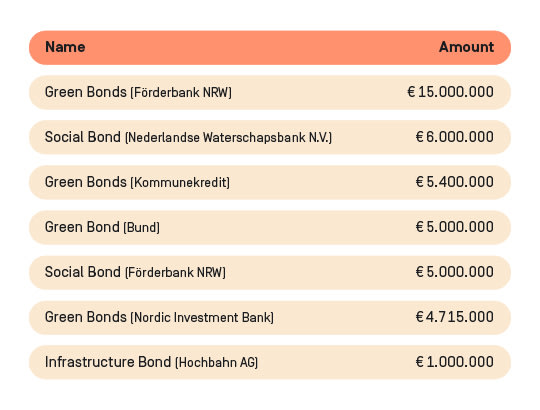

Here is an overview of our current investments:

What exactly are green and social bonds?

Even banks need money before they can provide loans. They borrow this from private investors (like you) or institutional investors (like Tomorrow or our partner Solarisbank) by selling securities called ‘bonds’ on the stock exchange. This is called refinancing and means they have to pay back the capital to the creditor (in this case Tomorrow/Solarisbank) after a specific term, together with interest. Tomorrow uses your money exclusively to acquire bonds that specify the sustainable projects into which the money is channelled.

Förderbank NRW’s Green Bonds

The green bonds are financial products issued by Förderbank NRW that are geared exclusively towards refinancing environmentally friendly projects that explicitly address the 17 Sustainable Development Goals (SDG) of the United Nations. We have invested antother €5 million in it, so it's an overall investment of €15 million in these green bonds. The main aims of the bonds are the development of renewable energies and the safeguarding of clean drinking water.

Almost half of the money raised by the new green bond is going towards the renaturation of the Emscher River (SDG 14 & 15). The other half is used primarily for wind farms, photovoltaic installations and grid extensions.

You can find out more about the green bonds and the areas they help to finance here.

Förderbank NRW’s Social Bond

Förderbank NRW’s Social Bond 2021 helps school authorities to speed up digitalisation and to increase energy efficiency by modernising buildings. However, it also helps to finance building alterations that make more inclusion possible (SDG 4 & 10). Money also goes to local authorities, for example for financing climate and flood protection, road infrastructure and making city centres vibrant and safe (SDG 10 & 11).

#Assistance is also being provided to small and medium-sized companies, which creates jobs and benefits structurally weak areas in particular. The loans promote digitalisation and innovations, allowing companies to remain competitive and, for instance, offer solutions for long-term and youth unemployment (SDG 8).

Another focus of these social bonds is sustainable and diverse cities, towns and villages where even young, low- to medium-income families can find affordable housing. This is why Förderbank NRW also provides loans to allow families with lower incomes to build their own houses (SDG 10 & 11).

You can find more information on our other impact investments and bonds in our app and here in the magazine.