Yep, 2020 certainly turned out very differently than we expected it to. Which makes us all the more grateful that, despite everything, we are still in a position to say that the last twelve months were actually pretty damn good for us personally. But how and why, you may be asking? Find out right here.

What can we say? For us as a global society, 2020 won’t exactly be remembered as a highlight. The pandemic has concerned, affected, unsettled and shaken us all – both professionally and privately. Which is why it makes us all the more humble and grateful to be able to say: here at Tomorrow we have managed to weather the storm very well, despite still having had the odd few challenges to overcome along the way.

But at the start of the year we decided to take the attitude that we were on this roller-coaster ride anyway, so there was no question of us slowing down or getting off before it ends. And that’s a good thing, because when we look back at everything we have achieved in the past few months, as a team and together with our community, there’s only one conclusion to draw: that whatever the year threw at us, all the hard work paid off in the end!

And the numbers speak for themselves: around 30,000 new customers, over 70 million euros more in customer deposits, almost 77,000,000 m² more protected forest and over 30,000,000 kg more of offset carbon.

Overall, we currently stand at:

But figures alone don’t tell the whole story, so come and join us on our quick run-through of the year!

Our time lapse of 2020 – first stop: Product and features

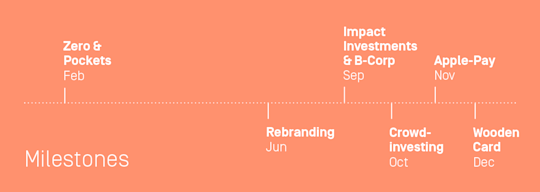

Let’s start our retrospective with the developments of our accounts and in the app. As soon as the year began, we started the ball rolling and in February Zero went live: the world’s first bank account that offsets the average carbon footprint of a person in Germany – around 11 tonnes.

10 percent of our customers are already getting involved – a number that is increasing daily. Which is great news of course, because thanks to Zero we can invest money that can help us join forces and really make a difference. To be more specific, this involved three projects in 2020: supporting small-scale farmers in Peru and therefore also protecting the rainforest from the threat of deforestation, the installation of clean biogas plants in Vietnam and drilling and maintaining boreholes in Uganda to give people access to clean drinking water and therefore remove the need to boil water over an open fire, which is harmful to the environment. The biogas plants project in Vietnam is now fully financed. We’ll be revealing the project that will be receiving our support next very soon – so make sure you stay tuned!

As part of our new account model, we also launched our ‘Pockets’, i.e. the sub accounts that you can use to put money aside for big purchases or simply save for a rainy day. And that’s obviously something that you’re really enjoying. Because by the end of November, our approx. 50,000 customers had already set up and stashed their cash in over 26,000 Pockets, with more and more new ones being added every month. So that means many of you are already well on the way to meeting your savings targets!

Apple, wood and a few other surprises

After a patient waiting on your part, what finally became possible this autumn? That’s right… Apple Pay. Late to the party – but better late than never, we always say!

And of course our cool new wooden card also deserves a mention. This is a moment we’ve been eagerly anticipating for a while – behind the scenes we have been chipping away at our plan to launch the first debit card made from wood for almost a year. But good things take time. Now that the wooden card has a firm place in our wallets, we plan on using it to appeal to those who are still hanging on to outdated ideas of consumerism and sustainability.

And while all of that was going on, our tech team has also been busy developing an IBAN scanner. Why? Because it makes your lives a lot easier. Having to type out annoyingly long numbers – which is oh-so-very-2019 anyway – is now a thing of the past!

At the beginning of December, our account switching service saw the light of day. So now there really are no more excuses for not turning your back on that bad bank you’ve been with for years but have been meaning to leave for a while.

What else? COVID-19, a new look, B-Corp, Impact investments

Yes, as a company we have also had to confront the coronavirus pandemic head on – which meant a transformation from virtually zero to fully remote in a matter of days. For example with new equipment to enable our team to work efficiently from home and by setting up a virtual recruiting process for many of the 50 new team members who joined us in 2020. But also with Healthy Home Office sessions, virtual onboarding, virtual team events, virtual coffee breaks, meditation and journaling sessions, virtual after-work beers – and more than a whopping 15,000 hours of Zoom meetings. Our HR department has bent over backwards to make sure everything continues to run smoothly. And thanks to the rest of our team also quickly getting on board, we managed to keep things ticking over nicely. Not just by hoping for the best, but by pulling together and staying optimistic and upbeat (or at least most of the time anyway!).

So while we were all sequestered away in our homes from March, we weren’t only tinkering away on our product itself. Because when COVID turned the world on its head at the beginning of the year, we decided to do the same to the look and feel of Tomorrow. We are now brighter, better, warmer and even more attractive. Because there are many sides to sustainability and that is what we wanted to show with our re-branding. And of course there was also a gorgeous new card to match.

The new design certainly elicited a variety of different responses from our community – covering the full gamut from jubilation to disapproval. And yes, we know: many of you were huge fans of its turquoise-green predecessor, but revolutionising the banking world will certainly take more than a green card. We want more – for us and for you. Interestingly enough, quite a few of our male customers said that they weren’t too keen on the apricot in our new design. But we know you won’t let it put you off… after all, colours have no gender!

Since September we have been officially good! That’s because we were B Corp certified, making us part of a global network that doesn’t promote growth over values and that works together to ensure that this ethos becomes the new status quo. There are currently over 2,500 B Corps across 130 sectors and 60 countries worldwide, such as Ecosia, Patagonia and Ben & Jerry’s. That means that we are in the best company and gives us confirmation that we are on the right track with our mission.

In keeping with that, we also increased our Impact Investments again in September, almost doubling them in fact. That means: as well as the 9,800,000 euros that are being invested in the Green Bond of the NRW Bank and the 50,000 euros for micro-loans, another 3,600,000 euros are going to a Green Bond of the Nordic Investment Bank and 6,000,000 euros to a social bond issued by Nederlandse Waterschapsbank N.V. So our Impact Investments now come to a total of 19,450,000 euros, which are currently financing renewable energies, climate-friendly transportation, affordable housing and sustainable communities.

Crowdinvesting, fundraising campaigns, additional Impact, our podcast, …

In October we reached another milestone on our journey with our crowdinvesting campaign. There was a lot to celebrate – and you lot were the ones throwing the party! 3,000,000 euros came together in just 300 minutes. Two numbers that still manage to put a smile on our faces and fill our hearts with gratitude. You are all fantastic – we can’t say it enough!

We were particularly pleased that so many young people chose to invest: 26 percent of the investors are between 23-27 years old.

This year we also launched two bigger fundraising campaigns to raise money for matters that are very close to our hearts. One was for Ärzte ohne Grenzen (Doctors Without Borders), which provides medical assistance to displaced people all around the world. And for the other we cooperated with the Amadeu Antonio Foundation, which is committed to preventing right-wing extremism, racism and antisemitism. We also launched a ‘Pay Now, Eat Later’ campaign during the first lockdown to support restaurants and collaborated with the Visions for Children initiative that is committed to the education of children worldwide.

In total, together with our community, your successful Tomorrow referrals, your upgrades to our Zero account and other initiatives, we raised almost 43,000 euros. Fantastic news!

And this year you also prevented 5,836 kg of plastic ending up in the ocean. That’s around 55,255 plastic bottles! Because for every Tomorrow card ordered after our re-branding, we donated one euro to the Plastic Bank. And on your behalf, along with a whole bunch of other activities we have also been able to stop ocean plastic and contribute to this impressive total.

And we also found the time to record the second series of our Über Morgen podcast. In this year’s episodes we chatted about old problems and new solutions with Kübra Gümüşay, Aminata Touré, Micha Fritz, Teresa Bücker and Linda Zervakis – resulting in a whole host of new ideas and approaches for a better tomorrow for us all. All of which adds up to 350 minutes of audio material! Have a listen!

Plus wie started Money Matters – Your Financial Guidance for a better future, to share facts and knowledge with you and discuss how we can manage money sustainably.

A lot of love and special messages

There’s also always a lot going on in the App Stores and our support team. Most of the feedback we receive is really good, so thanks for that! Sometimes the messages aren’t quite so positive and other times they really make us laugh.

To sum up, things have been going exactly how they should for a good bank: we are continuing to revolutionise the banking world, coming up with great products and contributing to a better future by making an impact together. So even if Tomorrow didn’t exist, we would have to invent a bank exactly like us!

But joking aside: even though we all love a bit of flattery and enjoy celebrating our success, we know that at the end of the day it’s only possible together with you. That’s why we want to express our thanks to you all again. For your confidence in us, your input, ideas, support and also your valuable criticism. So three cheers for you!

Wishing you all the best for a great start to the New Year.

P.S. If only we could reveal to you what’s already in the pipeline for 2021… but as we don’t want to spoil the surprise, you’ll just have to take our word for it when we say: the best is yet to come!