Sustainability Report 2023

Tomorrow was founded to use money as a lever for positive change. That's why we are delighted to once again share with you in detail in our annual sustainability report what we have achieved together with our community in this mission - from partial steps to milestones.

You can get some first insights here and find all the details in the report.

Day-to-day business

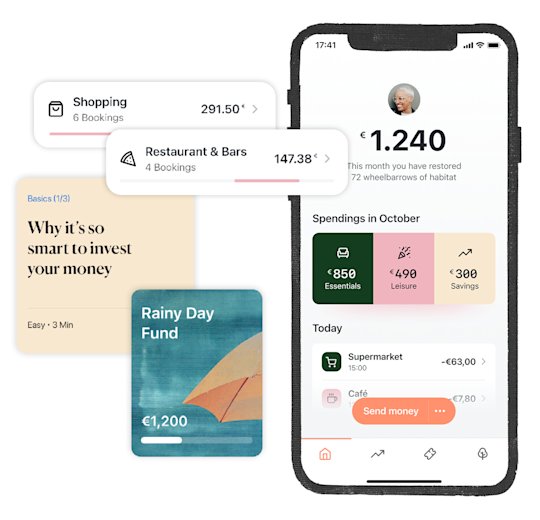

We want to establish sustainable finance at the heart of society by offering a comprehensive and easy-to-use range of financial products. The focus is on ensuring that the money in our customers' accounts is used sustainably. We also want to encourage our customers to make their own financial decisions in a sustainable way. In 2023, we have further developed our offering and are providing even more features to help people understand their own financial situation and save or spend money responsibly.

Our product innovations 2023

The new Monthly Summary

Intuitive and trustworthy break-down of individual spending habits per month, in order to create transparency for our customers and support better decision-making in financial decisions.

Auto Savings Feature

With the launch of this new feature, saving is done automatically and users are supported to save regularly and to potentially improve their control over finances and hence, their financial freedom in the future.

Rainy Day Fund (Pocket)

The Rainy Day Fund is a tool designed to help users in establishing a financial safety net with ease and minimal effort. By removing significant obstacles, it offers a means to enhance one's financial wellbeing.

Launch of the Quick Donation Feature

This feature enables us to respond quickly to issues and disasters and to launch appeals for donations for acute crises or organizations. You can find out more about the projects and organizations supported in section 5.3 “Climate protection and social projects”.

Also new in 2023

Launch of the Overdraft Feature

For even more security and flexibility for our customers, we have introduced the overdraft feature that can be used for unexpected costs.

In-app guides

In addition to the wide range of inspiration on financial topics in our magazine, we have also been offering financial guides directly in our app since 2023, which provide basic information and suggestions in the area of finance.

Impact milestones

We look back with pride on the impact milestones we achieved last year. To name just a few: We were able to implement further sustainable investment options, were listed among the top 3 of the Fair Finance Guide, visited our Spekboom renaturation project in South Africa and were the first startup in Germany to give a crowdinvestor representative a seat in our Advisory Board to ensure even more participation. In addition, our community has rounded up and donated hundreds of thousands of Euro for climate protection and social projects and we have joined forces with 16 other financial institutions to change the banking system at the European level towards substantial sustainability.

January 2023

Rounding Up with Die Tafel: €51,712 were rounded up to facilitate access to food for the increasing number of people affected by poverty in Germany. A detailed description of the project can be found in the Sustainability Report 2022.

Rounding Up update: The Rounding Up feature now includes details on how much an individual user contributed to the respective project.

February 2023

New wave of Benefits partners: Since its launch, the Benefits feature has welcomed more than 80 brands.

On site in South Africa: Some Tomorrow team members visited the Spekboom renaturation project in South Africa, performed an internal audit and got to meet the EcoPlanet Bamboo Group team.

March 2023

Rounding Up with Climate Partner Foundation: €101,523 were rounded up to support good working conditions for on-site staff of the Spekboom renaturation project with the installation of rainwater collection tanks, worker safety training, a lunch feeding scheme and solar panels installations.

Fair Finance Guide: Tomorrow ranks 3rd in the Fair Finance Germany Guide with a 91% performance.

June 2023

Goodbye Footprint Feature: We have decided to say goodbye to our CO₂ Footprinting Feature. Tomorrow believes in systemic change and does not want to put the burden of solving the climate crisis on individuals.

Rounding Up with UNICEF: €155,695 were raised to provide direct support in response to the earthquakes in Turkey and Syria.

Crowd X Advisory Board: As our biggest investor, we are bringing the crowd into the most important body of the company: the Advisory Board. Welcome Anne Geiger!

August 2023

Investment option solar bonds: From June 13 to July 11, 2023, our customers invested €748,800 in the WIWIN Waldböcklheim solar investment project via the app and thus made an active contribution to the energy transition and the promotion of green and clean electricity.

September 2023

Our Planet, Our Business: More than 100 companies joined our initiative “Our planet, our business” with Entrepreneurs for Future for the Global Climate Strike.

October 2023

Wind bond investment option: Together with our partner WIWIN, we made it possible for our customers to invest in the growth of wind energy: From August 23rd to October 25th, 2023, our customers invested a total of €514,050 in the Sickinger Höhe wind bond directly through the app.

November 2023

Sustainable Banking Coalition: Tomorrow participated in building the Sustainable Banking Coalition in Brussels alongside 16 other financial institutions. The Sustainable Banking Coalition is a group of financial stakeholders who have united to address market and policy failures and transform the current banking system towards substantial sustainability.

December 2023

REACT with Impact: We’ve been granted funds for the program “REACT with Impact” of the Federal Ministry for Economic Affairs and Climate Action of Germany (Bundesministerium für Wirtschaft und Klimaschutz).

Rounding Up with Visions for Children: Our so far biggest Rounding Up project collected €375,868 to provide access to quality education and to improve the learning conditions of the Muaz Bin Jabal Middle School in Kabul province, Afghanistan.

Our value chain

Tomorrow has been focusing on tackling change across its value chain from applying strict criteria to the selection of partners or investments and also across its downstream fields of action, e.g. by addressing our customers’ financial planning or consumption decisions. We aim at improving efficiency by encouraging upstream suppliers to reduce their own footprints and by reducing the carbon impact of the products and services we offer.

With our strict criteria we make sure to offer our services throughout our value chain in respect of all human rights as described in the United Nations Guiding Principles on Business and Human Rights and have a zero-tolerance policy towards all forms of discrimination in employment or service delivery, including on the basis of gender, race, ethnicity, sexuality and physical ability.

By the end of 2023, we have also rolled out a sustainable supplier onboarding process detailing different methods to assess a supplier’s sustainability practices. This will be valid for all new suppliers of Tomorrow as of 2024.

Sustainability and impact strategy

We mainly monitor the impact performance at Tomorrow by looking at a set of key performance indicators including

Total future CO₂e t removals financed.

Total m2 of ecosystems renaturated.

% of customer deposits invested sustainably.

Assets under Management (AuM) invested sustainably in €.

Number of people empowered (number of jobs created, people educated, people improving their financial wellbeing by showing higher levels of savings and investments).

Total donations enabled by Tomorrow in €.

What we achieved in 2023

Product

We enabled the investment of €1,3M in solar and wind bonds in partnership with WIWIN to support the transition to a net-zero economy.

We have developed three features for our customers that make it easier to manage their finances sustainably. The Rainy Day Fund makes it easier to build up savings and the automated savings and monthly overview help to set financial goals.

We launched the overdraft feature which allows our customers to react flexibly to unforeseen costs.

Customers

Together with our community we raised €703,017 through Rounding Up and other donation initiatives.

We have doubled our investment in the Spekboom Eastern Cape renaturation project in 2023 vs 2022.

Organization

We have made substantial steps towards becoming profitable.

We identified Corporate Activism as a new impact driver and launched our first initiatives through our public participation in political and social debates, social engagement, shareholder activism and the promotion of climate and social change.

We invested in our employees’ development by kicking off a Micro Training Budget for personal development including up to three paid days off for all employees.

Partnerships

We have improved our supplier screening process, finalized new onboarding procedures and are ready to launch.

We visited and audited the climate protection projects that we support through the Zero account model.

Foundational

We have started our B Corp recertification process for 2024.

We ranked 3rd position in the green tier of Fair Finance with a score of 91%.

Anne Geiger became the first crowd investor on our Advisory Board.

Transparency

At Tomorrow, transparency is king and queen. We disclose in real time – both on our app and our website – the value of the total customer deposits and how they have been invested, how many Tomorrow customers there are and how many square meters of ecosystem have been renatured through the interchange fee, referrals and the premium accounts Zero. With the information we make public, it is always possible to see what projects we are supporting and what their outcome is. We also publish quarterly impact updates since 2022 that can be found at any time on our Magazine section of the website.

We are always working on identifying the most relevant measurement parameters with which we can show our impact even more transparently and set ourselves measurable targets. We still base our activities closely on the Sustainable Development Goals. For the investment product that we have launched in 2022, we publicly disclose the compatibility with Paris Agreement targets and the securities (companies and bonds) contained in this product. The same applies for any form of interaction, engagement and contribution to social and ecological topics (e.g. in the form of voting or shareholder engagement) since we now publish on our website our list of engagements for the Tomorrow Better Future Stocks fund.

Handprint

Our main impact levers are considered as our handprint: as an innovative and holistic approach to ESG. The handprint determines, measures and evaluates positive sustainability impacts including the social and economic dimension that the company causes outside of our footprint.

In addition to minimizing our own ecological footprint, at Tomorrow we focus on maximizing our positive impact.

This is how our handprint is made up in 2023:

Banking: Zero accounts and customer deposits create positive impact through direct and secondary market investments and political advocacy.

Card Payments: Unlock impact through Interchange Fee and Rounding Up impact through direct investments and donations.

Investing: Secondary market and direct investments are funded through the Invest product and crowdinvesting.

Sustainable Lifestyle: The Benefits feature provides motivation for more sustainable purchasing decisions.

In 2023, we have achieved on average a ratio of around 40% of customer deposits invested sustainably. Added to this is the money invested in the Tomorrow Better Future Stocks fund. While deciding for relevant investments is 100% based on the respect of our strict investment criteria, we also aim to follow the United Nations Principles for Responsible Investment (UNPRI).

As an impact-oriented fund, the Tomorrow Better Future Stocks (TBFS) fund does not only seek to generate financial returns but is also in line with the Paris Agreement and invests exclusively in securities that follow our strictest investment criteria. This means that it meets the requirements set out in Article 9 of the EU Sustainable Finance Disclosure Regulation (SFDR). By the end of 2023, the fund managed € 7.251 million in assets.

Tomorrow managed to contribute to the expansion of renewable energy in collaboration with its partner WIWIN. In 2023 we offered our customers the unique opportunity to invest in the development of the Solarpark Waldböckelheim and the windfarm Sickinger Höhe, both initiatives that promote the transition to green and clean electricity. As part of this initiative, Tomorrow enabled its customers to invest a total volume of € 748.800 in the Solarpark Waldböckelheim and a total volume of €514.050 in the Windpark Sickinger Höhe.

Overview of all 2023 climate protection & social projects

At Tomorrow, we use part of the interchange fee to finance climate protection projects and CO₂e reduction projects. In 2023, the interchange fee further financed the Eastern Cape spekboom restoration project in South Africa. Because of the interchange fee, referrals and the Zero account, from January until December 2023:

over 444 hectares have been planted.

1,110,850 Spekboom seedlings have been planted.

115 jobs (including long-term and short-term jobs) were created for local communities.

14,000 m (total year to date) of fence line cleared and fenced.

Slideshow- Image 1

As mentioned, the Spekboom renaturation project continues to be part of the three projects financed by our Zero customers. We also support the Carbon Collectors and the Clean Air Task Force. In 2023, the financial support for these projects:

financed the removal of 26,624 tonnes of CO₂e.

restored the equivalent of 1 million m2 of ecosystems.

raised donations of €69,508 to support the technological and political change needed to transition to a zero-emission economy.

In December 2021, we launched our Rounding Up Feature as another lever for positive change. In 2023, the supported projects focused on social aspects such as the improvement of living conditions in South Africa, poverty alleviation in Germany, humanitarian aid for earthquake victims and also contributed to give better access to education to local communities in Afghanistan.

When selecting the projects, we focus on the central aspect of climate justice, specifically combating the unequal distribution of the effects of the climate crisis. In 2023, the Rounding Up feature supported a total of four projects and raised over €660,000.

1. Spekboom social impact projects

€80,000 donated.

A total of 115 jobs were created, of which 110 were seasonal and 5 full-time jobs.

2. Emergency relief aid in Turkey and Syria

€112,500 donated.

More than 1,100 medical first aid kits could be provided

more than 660 people could receive hygiene sets

more than 6,200 people could receive warm blankets.

3. Quality education and climate justice in Afghanistan

€300,000 donated.

350 pupils and 8 teachers empowered to learn and teach in decent conditions.

Around 150 jobs supported or created to complete the school renovation sowie die Lehrenden fortzubilden

Since May 2022, our Referral campaign is contributing to the Spekboom Eastern Cape renaturation project in South Africa. Each successful referral triggers a €1.52 investment into the project and therefore generates 3m2 of renaturated land in South Africa. Project outcome in 2023:

31,950 m2 of habitat were restored.

7,987 Spekboom seedlings were planted.

638,987 liters of water were supplied to an area affected by drought.

Corporate Activism

We are proud to have introduced "Corporate Activism" in 2023 as a new impact lever to demonstrate our strong stance on pressing environmental and social issues through our public participation in socio-political debates and to drive positive change through political action, community engagement, shareholder activism and the promotion of climate and social change. We see it as our shared responsibility to advocate for systemic change in the financial sector that combines profit-oriented goals with sustainability, transparency, and ethical responsibility in business operations. To this end, we not only want to lead by example, but also join forces to move closer to a sustainable, inclusive future, in particular by proactively shaping the future and working together with the Sustainable Banking Coalition and our involvement in grassroots movements such as Fridays for Future. In 2023, we have taken the first steps on the journey of corporate activism that will take us from advocacy to tangible, progressive change.

The Sustainable Banking Coalition

Although feedback is essential to a productive development of the EU Sustainable Finance plan, our advocacy efforts in Europe don’t stop here: together with the members of the newly created Sustainable Banking Coalition, we urge the European Commission for more ambitious sustainability reporting standards. Transparency from businesses on their social impacts is vital for a sustainable European economy.

We as Tomorrow want to show that businesses can thrive with high standards of social and environmental performance, accountability and transparency. In that context, we have come together with a group of 12 other sustainable financial institutions in Brussels with the help of #sustainablepublicaffairs.

The Sustainable Banking Coalition is an initiative that brings together all European actors paving the way to transform Europe’s banking system to the benefit of people and the planet. The group transcends conventional ways of working by providing a platform not only for banks, but also for neobanks and other financial institutions. The uniqueness of the Sustainable Banking Coalition lies in its sharp focus on fossil fuel renunciation and climate justice. This robust baseline of non-negotiables for the transition aims at uniting all actors active in the space, such as the members of FEBEA (European Federation of Ethical and Alternative Banks and Financiers) and GABV (Global Alliance for Banking on Values), as well as B-Corp certified financial institutions.

Footprint

Year after year, we improve the measurement of our carbon footprint, for which we also adapt our scope 3 emissions and continuously create a more comprehensive level of detail.

We believe that by maximizing our handprint and positive impact on the planet while containing our emissions to their current (or lower) level is the right way to go. Our aim remains to keep 2022 footprint levels per employee although growing our number of collaborators and the positive impact generated by investments, projects and impact initiatives. We also continued to focus on a few important elements to lower emissions:

Actively engage with our current suppliers or potential invested companies to understand, disclose and cut their emissions.

Be even stricter in our supplier selection criteria when onboarding new partners.

Educate our customers further on how to lower the footprint linked to their bank account, card transactions and overall consumption

The values required for sustainability and positive change are reflected in our corporate values and represent a guiding principle in our day-to-day work and the basis of fair entrepreneurship. Our work is based on the Universal Declaration of Human Rights and the International Labor Organization's Declaration on Fundamental Principles and Rights at Work. In addition, we encourage all forms of whistleblowing - we recorded no cases in 2023.

To achieve our goals, we have also significantly increased our compliance efforts since 2022. We have created or improved internal guidelines. These include, for example:

Manifesto (Code of Conduct)

Compliance Policy

Data Protection Policy

IT Security Policy

People & Culture Policy

We have conducted numerous interviews with all stakeholders within Tomorrow to create a process and risk inventory, where we recorded the relevant processes of our internal departments, assessed the inherent risks and worked on mitigation measures.

All of these measures have been incorporated into a newly created organizational handbook that is accessible to all employees and which helps us to significantly improve compliance in all areas. We consequently also appointed our own Chief Compliance Officer at the beginning of the year to set up, structure and monitor these activities.

In addition, we are in close and regular exchange with the compliance department of Solaris SE, which advises and audits us in this respect.

In 2023, we changed our definition of what is defined as a “complaint”. To pinpoint all opportunities for enhancing our service, we, in partnership with Solaris SE, have chosen to categorize every instance of customer dissatisfaction as a formal complaint. Therefore, in 2023, we identified 1,050 cases as complaints across all channels. This only equals a ratio of 0,24% of all support requests. These cases were limited to general issues with account usage and did not involve any misconduct by our employees. Our customer support team successfully resolved all complaints in collaboration with the individuals involved.

Our business is supervised by two organs: the Advisory Board and our very own Impact Council. Our shareholder agreement states that Tomorrow is a company that aims to have a significant positive impact on society and the environment. It also states that the strategic decisions of our Directors - currently our founders - will take into account all relevant stakeholders (shareholders, employees, customers, society, etc.) and the impact on the environment, both locally and globally.

We see tax compliance as being an essential pillar of any sustainable company. This means that we avoid tax avoidance, both for ourselves and for investments, customers and suppliers. We categorically refuse to include tax avoidance strategies as part of the financial consulting services we provide to existing and future customers. By the same token, we refuse to accept as a customer any company that is based in tax havens for strategic reasons and that does not generate the bulk of its revenue locally.

We believe in the value and competitiveness of our products and services and we are committed to conducting business ethically. As such, we will never engage in corruption or bribery to secure contracts, partnerships, or other undue advantages, nor will we put others at a disadvantage.

So now you want to find out more and see all figures and insights?

Read our sustainability reports here.

Disclaimer & risk notice: The mentioned investment products are associated with risks as the value of your investments may increase or decrease in value. You may lose your invested money. Price developments in the past, simulations or forecasts are no reliable indicator of future performance.

The text does not contain investment advice or recommendations to buy or sell. Visualizations are for illustrative purposes only and do not represent actual or future performance of the fund.

Our partner Solaris SE is the provider of all banking services. Additionally Tomorrow GmbH offers the brokerage of the above-mentioned investment product as a tied agent within the meaning of § 3 para 2 WpIG in the name and for the account of lemon.markets brokerage GmbH and is entered in the public register maintained by the German Federal Financial Supervisory Authority (BaFin). The register can be viewed at https://portal.mvp.bafin.de/database/VGVInfo/vermittlerSucheForm.do.